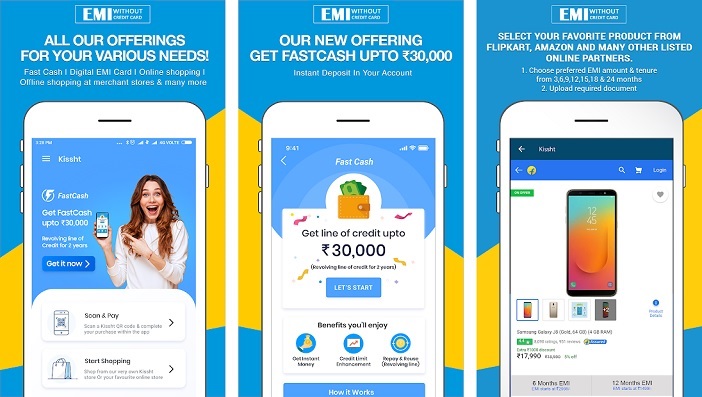

Kissht is India’s fastest credit app where one can avail purchase financing and revolving line of credit. The purchase financing can be availed for mobile phone, laptop, camera, & many more electronic gadgets. Further, 2 years revolving line of credit can availed, akin to credit card.

Kissht App Founder & Release Information:

- Founder(s): Karan Mehta, Krishnan Vishwanathan

- Employees: 250+

- Headquarters: Mumbai, Maharashtra, India

- Founded: July 13, 2015

Kissht App Features:

With Kissht, bid adieu to your financial worries! Get credit with zero collateral and APR ranging from 14% – 31% per annum for a tenure of 3 months to 24 months. Avail any amount starting from Rs. 3,000/- to Rs. 1,00,000/- depending on your eligibility.

Loan Types

- Online Purchase Loan – Kissht is a one-stop destination to get your desired products like smartphones, laptops, cameras, and any latest electronics on EMI and repay within 3 months to 24 months tenure. This loan can be used to make purchases at Flipkart, Makemytrip, etc.The APR is between 14% and 24%.

- Personal Loan – Kissht also offers Personal loans for salaried & self – employed professionals for their various needs. The amount ranges from Rs. 3,000 to Rs. 1,00,000/- with a tenure ranging from 3 months to 15 months, depending on the person’s eligibility.The APR is between 16% to 28%.

- Revolving line of credit – Kissht also offers credit limit for 2 years (24 months). This is a revolving credit facility, where the customer can avail the limit seamlessly for next 2 years, till the customer is paying on-time. To incentivize better credit behavior, the customer is offered waivers and reduction in instalment amount for timely payments.The customer can avail upto a credit limit of Rs. 30,000. The APR is between 20% and 31%.

Amount, Tenure, Fees &Charge

- Loans range from ₹3,000 to ₹1,00,000 with tenure ranging from 3 months to 24 months. The APR ranges from 16 to 31% depending on the product availed, risk profile, and creditworthiness of the customer.

- Penalty charges are charged only when a customer defaults or delays their loan repayment schedule in spite of reminders. In addition to it, GST applies as per Indian laws.

APR Examples

- Loan Amount: Rs. 20,000 for OnePlus 5 @ 16% interest rate per annum, Tenure of 6 months, Processing fee: Rs. 300. EMI amount: Rs. 3490/month. APR: 21.33%

- Loan Amount: Rs. 48,000 for iPhone @ 20% interest rate per annum, Tenure of 15 months, Processing fee: Rs.1,200. EMI amount: Rs. 3643/month. APR: 24.03%

- Customer availing a revolving line of credit of Rs. 25,000 for a period of 2 years. Over a two-year period, the total fees (includes processing fees and a one-time initiation fee) charged is 9%. The interest rate is 18% per annum. The APR for the revolving lines come as 28.54%.

- 100% online (paperless) process

- Minimal documentation

- No Credit Card required

- No collateral required

- Secure transaction (128-bit SSL encryption)

Eligibility Criteria:

- Indian Nationality

- Minimum age of the applicant should be 21 years

- Minimum monthly income of Rs. 12,000/-

Documents:

- Address Proof (either of AADHAR Card/Latest Utility Bill/ Valid Rent Agreement)

- PAN Card

- Last 3 Months’ Bank Statement

- 1 Signed ECS Form for auto-debit

Kissht App Google Play Store Information

- Updated: February 17, 2020

- Size: 19M

- Installs: 5,000,000+

- Current: 1.6.9

- Requires: 4.4 and up

- Content Rating: Rated for 3+

Find out What keywords People using when searching for Kissht App on Google Search Engine

- kissht cash loan

- kissht finance wikipedia

- kissht available pincode

- kissht finance personal loan

- kissht loan app

- kissht personal loan eligibility

- how to use kissht emi card

- kissht company details

- kissht app download

- kissht app apk download

- kissht remote android app download

- kissht android apk download

- kissht app not working

Download App From It’s Store:

Download Kissht Android App From Google Play Store

Download Kissht IOS App From Apple iTunes Store

Download App From It's Store:

Google App StoreURL

Itunes App Store URL

Developer Information:

Name: Kissht KisshtEmail: care@kissht.com

Developer Website: https://www.kissht.com/

Social Media Pages:

Facebook PageTwitter Page

Google+ Page